Understanding the problem

What is regular rate of pay?

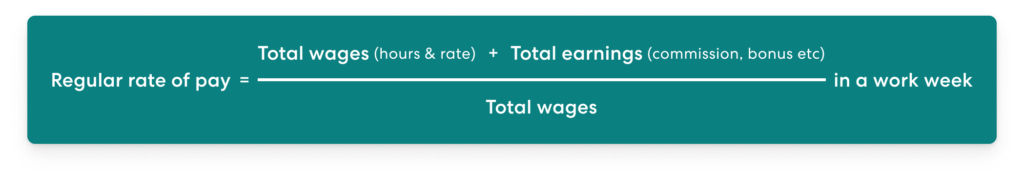

Regular rate of pay (RRoP) is a payroll concept used to calculate overtime premiums under the Fair Labor Standards Act (FLSA) for non-exempt hourly and salaried employees.

Why it's important?

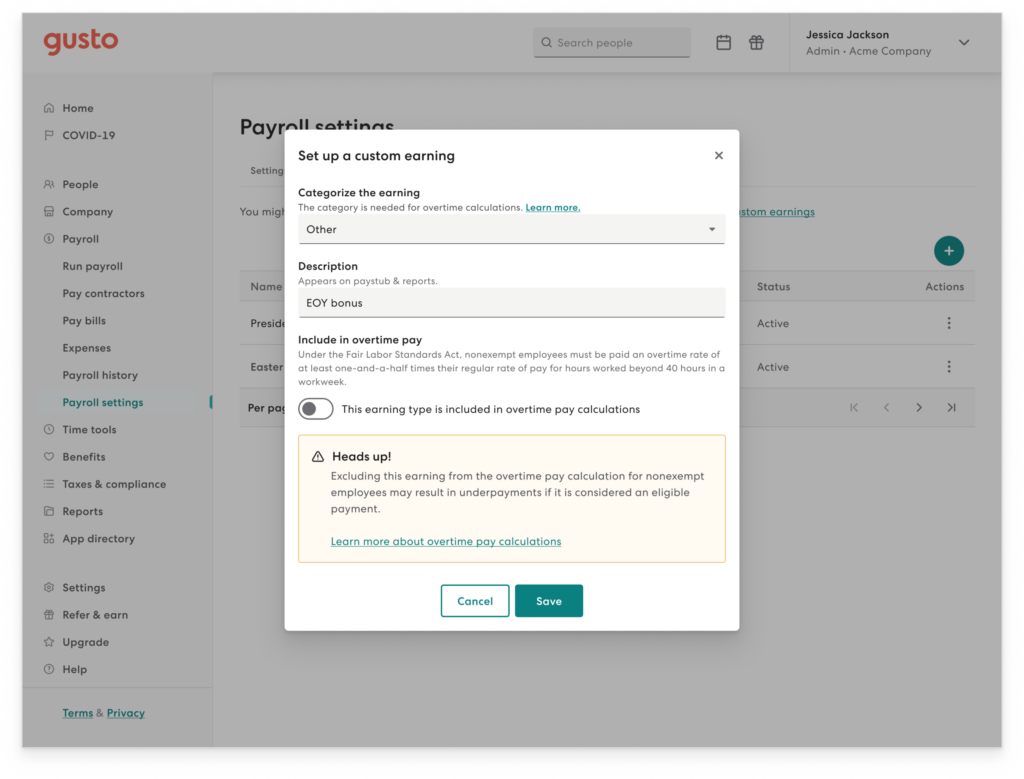

As per the FLSA regulations, Gusto must calculate an employee’s gross pay based on their Regular Rate of Pay, which takes into account any additional earnings or overtime worked by a nonexempt employee. To ensure precise calculations, Gusto requires detailed information on the employee’s work hours and earnings per work week.

Regular rate of pay formula

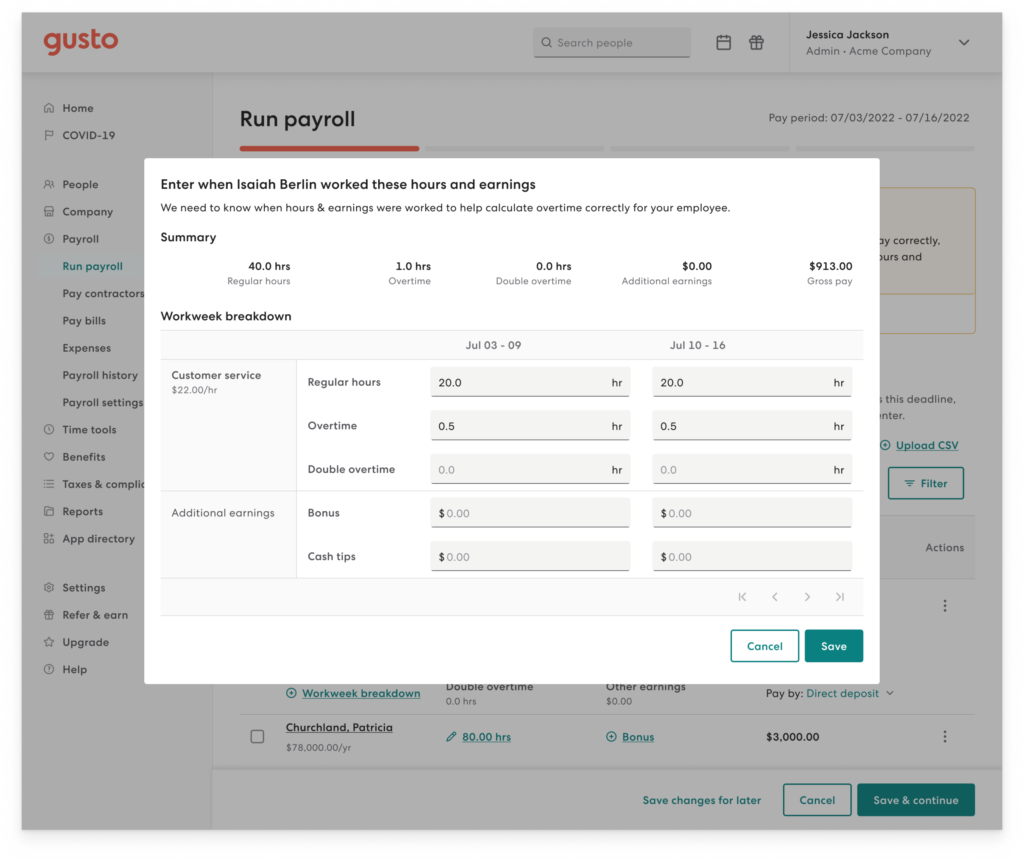

What's a workweek?

A work week is any seven, consecutive 24-hour periods established by an employer. For example, a standard work week starts Sunday and ends Saturday.

Why does it matter to Gusto?

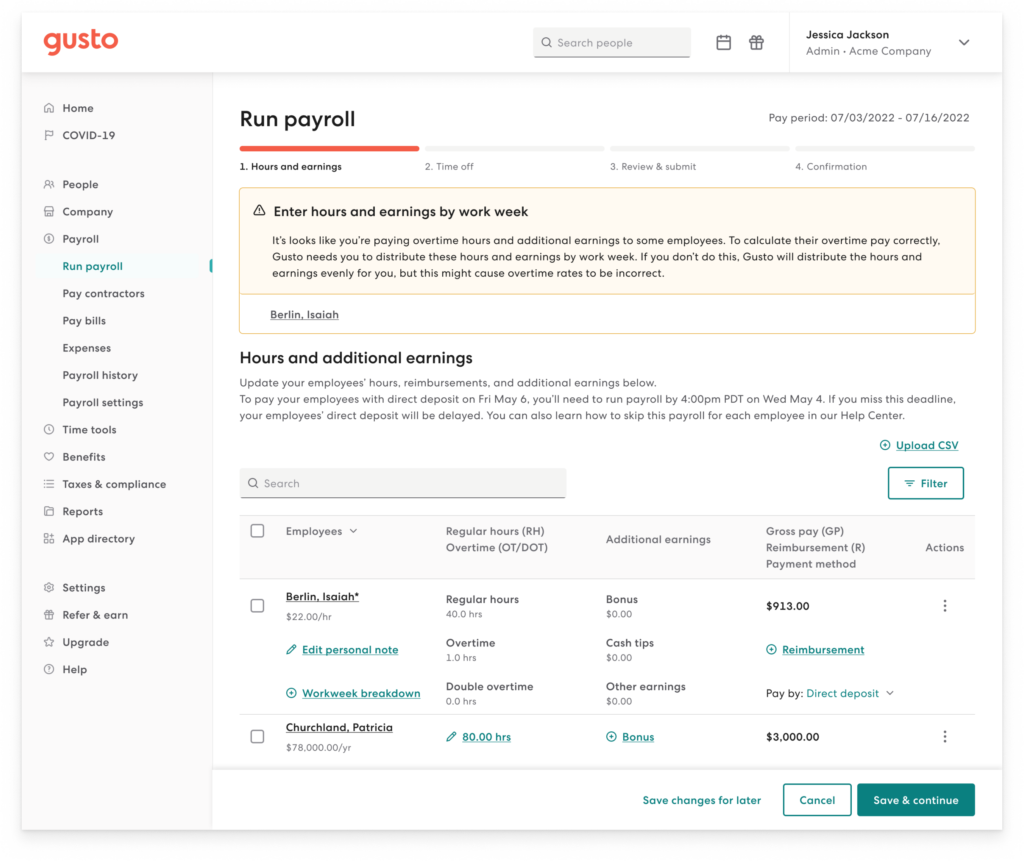

Customers who use Gusto’s time tracking product have a concept of a work week in Gusto’s payroll product. However, customers who do not use the time tracking product cannot associate the hours worked or earnings earned with a specific work week, increasing the risk of potential underpayment of their employees.

Regular rate of pay formula